Track. Understand. Reduce your taxes — effortlessly.

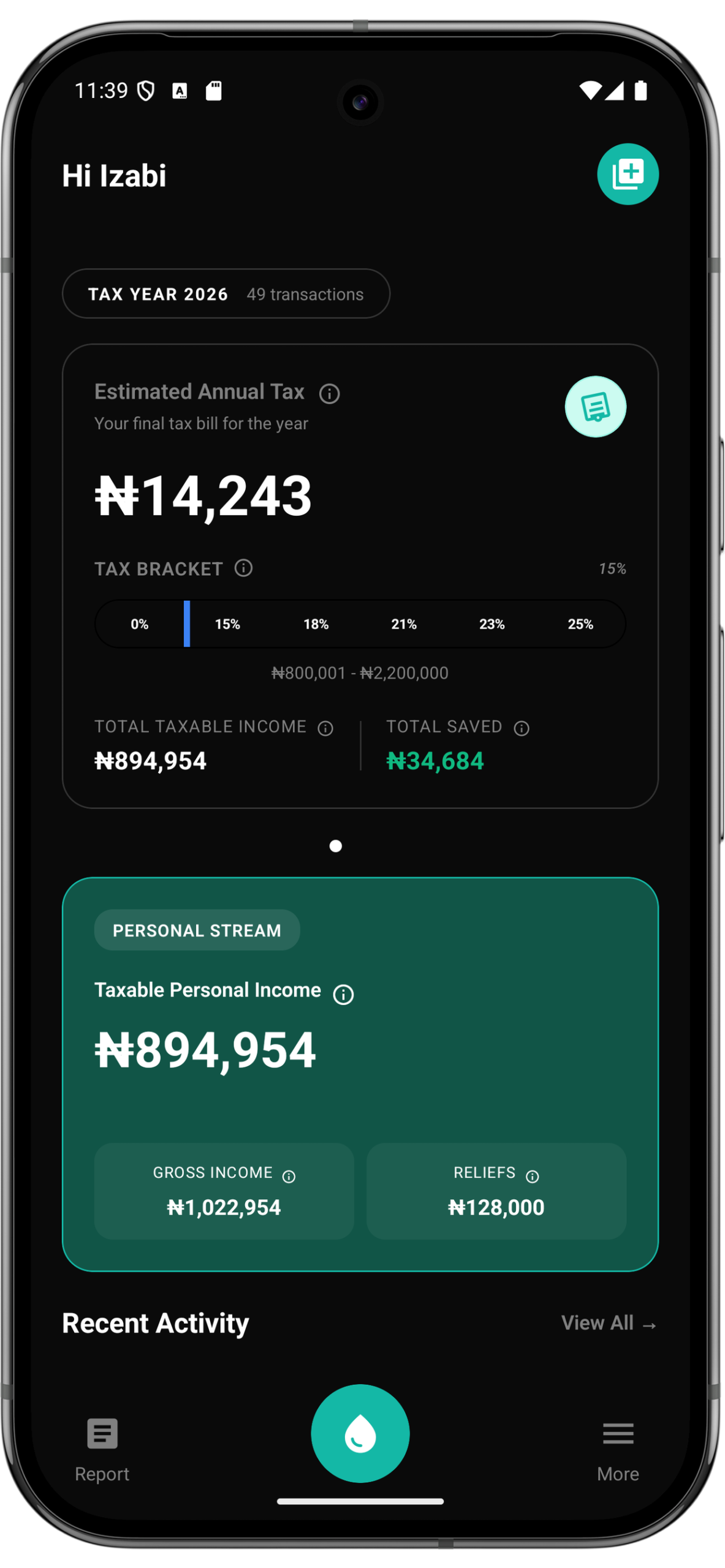

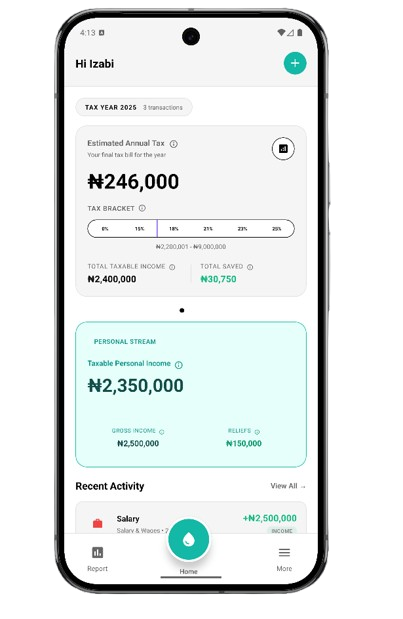

Taxrain helps working Nigerians log income and expenses, understand tax obligations, and legally reduce their tax burden under Nigeria’s tax laws.

Taxes shouldn’t feel confusing or invisible.

You earn money but don’t know how much tax you really owe

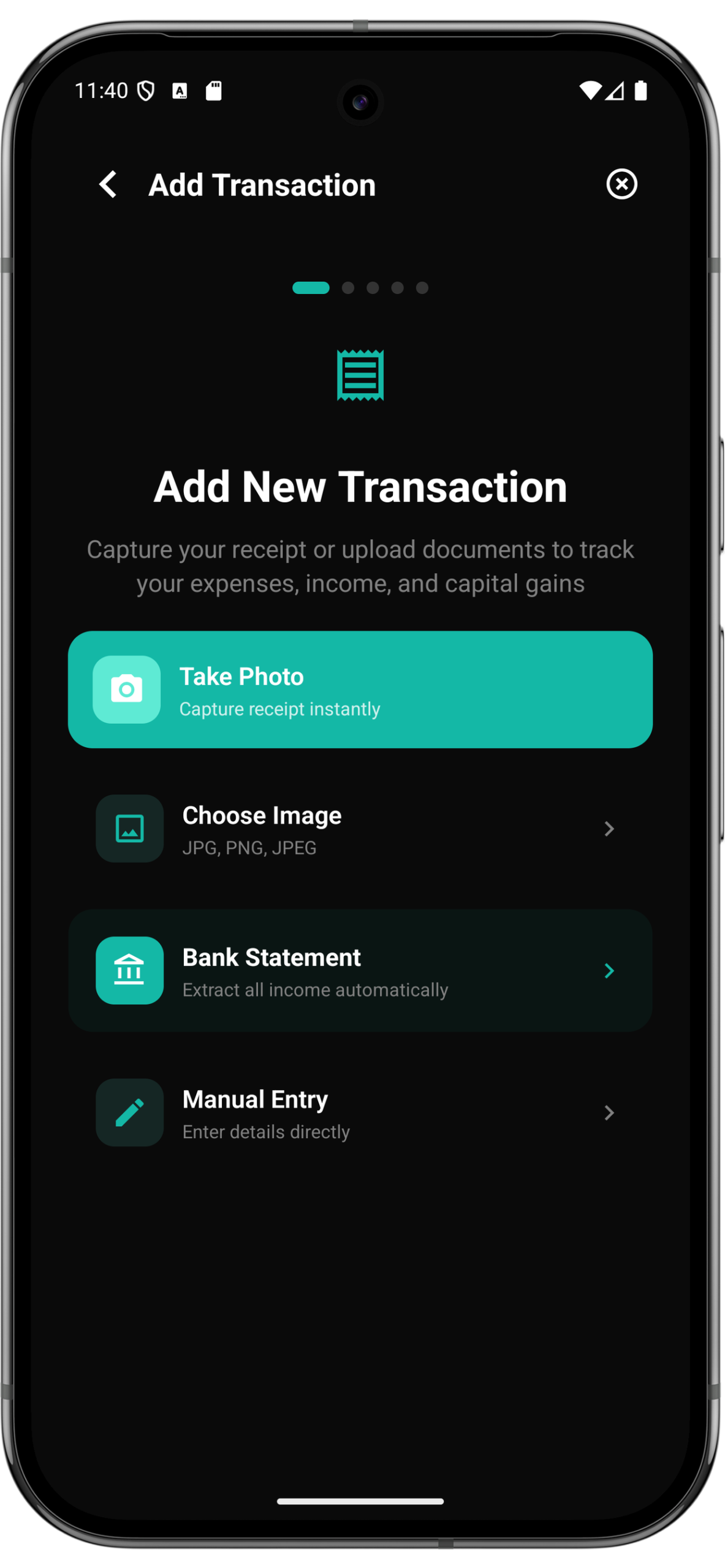

You make deductible expenses but never track them properly

Tax rules are complex, scattered, and hard to apply daily

Most people only think about tax once a year — too late

Your daily money, translated into tax insight.

Built for how Nigerians really earn.

Employees

Track salary, reliefs, and personal deductions

Self-Employed & Creators

Log business income, expenses, and capital assets

Hybrid Earners

Separate personal and business finances — cleanly

by Taxrain

Connect by Taxrain is a business platform that allows companies to securely send tax-ready transaction data directly to their customers’ Taxrain apps at the point of purchase.

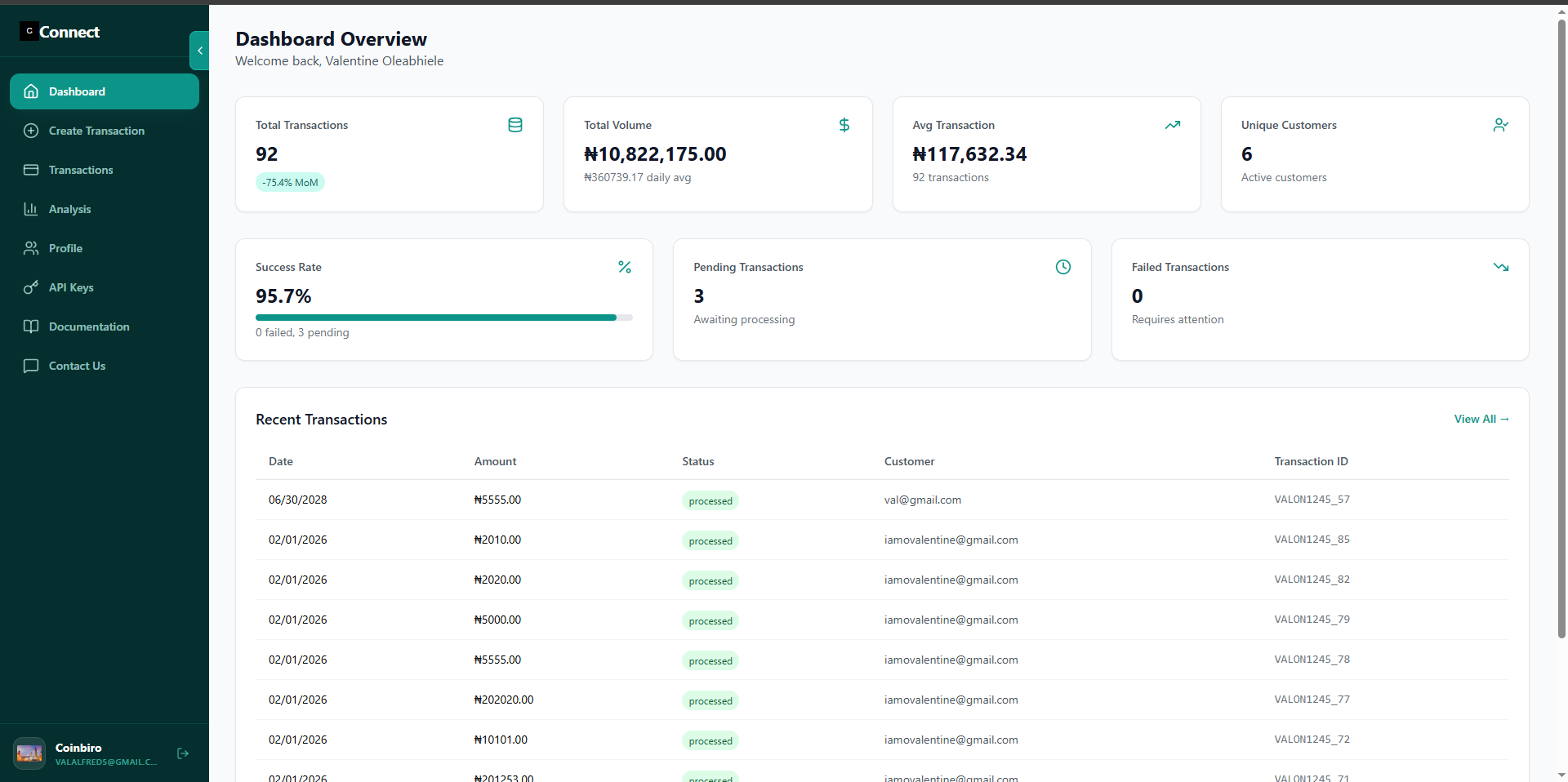

How It Works

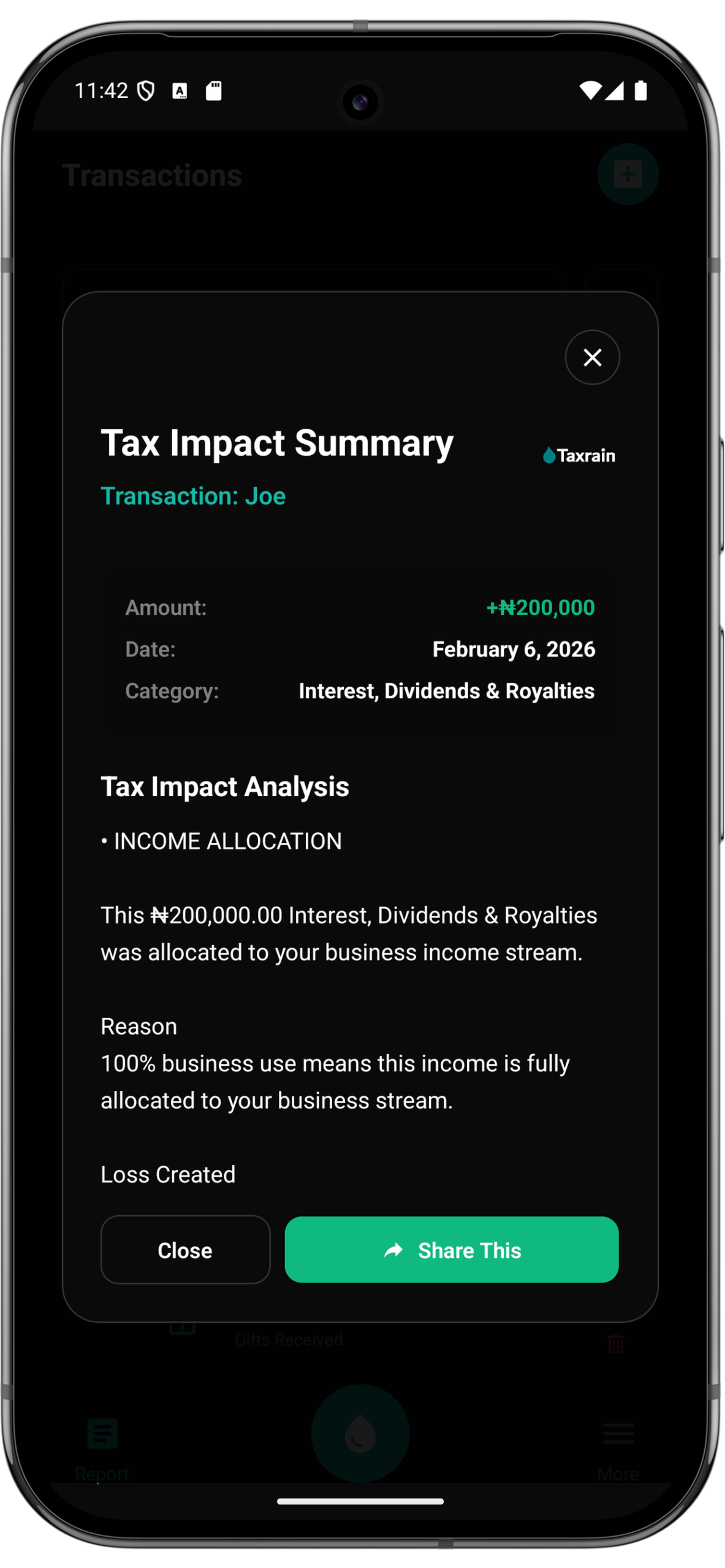

When a customer pays, the transaction is recorded as tax-verified and instantly reflected in the customer’s tax summary—helping them track deductible expenses, understand tax impact, and stay compliant in real time.

Customer Benefits

Customers don’t need to upload receipts or manually log expenses; the record is already prepared for tax use. Every transaction becomes tax-ready automatically.

Business Benefits

For businesses, Connect adds value beyond the standard invoice. It positions your business as tax-aware and customer-centric, reduces post-purchase tax questions, builds long-term trust, and gives customers a practical reason to return.

Simple Integration, Maximum Value

Easy Setup

Integration is simple—businesses can post transactions manually, in bulk, or via API

No System Changes

Works with your existing billing or accounting systems without disruption

Secure & Reliable

Bank-level security with encrypted data transmission and storage

Stop guessing your taxes. Start understanding them.

No credit card required. Free forever for basic tracking.